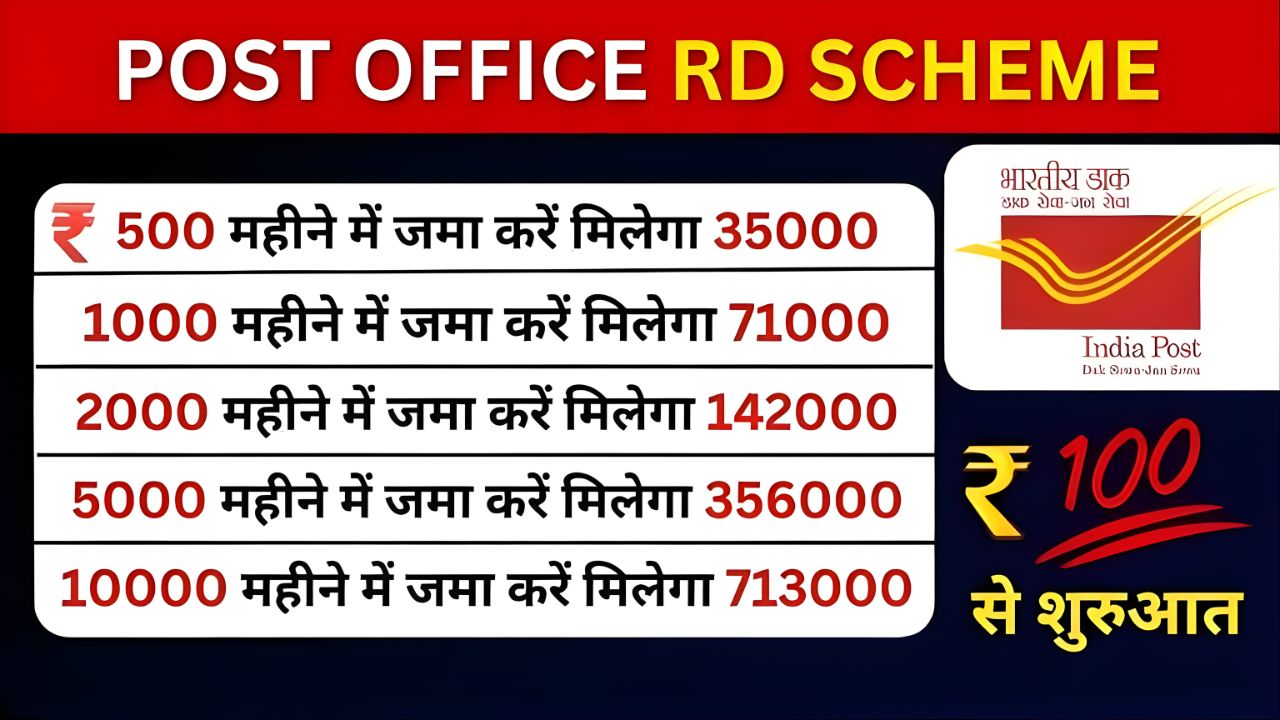

For risk-averse investors looking for guaranteed returns, the Post Office Recurring Deposit scheme remains one of the most trusted savings options in 2025. By investing ₹10,000 every month for five years, individuals can build a disciplined savings habit and receive a maturity amount of around ₹7.13 lakh. Backed by the Government of India, the scheme continues to attract salaried employees, small business owners, and long-term planners.

How the Post Office RD Scheme Works

The Post Office Recurring Deposit allows investors to deposit a fixed amount every month over a chosen tenure, typically five years. The scheme is designed to encourage regular savings while offering stable interest earnings. Deposits are made monthly, and interest is compounded quarterly, helping the investment grow steadily over time.

Monthly Investment and Total Savings

With a monthly contribution of ₹10,000, an investor deposits a total of ₹6 lakh over five years. This structured approach makes it easier to save without financial strain, as the amount is spread evenly across months rather than requiring a lump-sum investment.

Interest Earnings and Maturity Value

At the current applicable interest rate, the total investment of ₹6 lakh grows to approximately ₹7.13 lakh at maturity. The additional amount reflects the interest earned over the five-year period. This predictable growth makes the Post Office RD an appealing option for conservative investors who prioritise safety over high-risk returns.

Who Should Consider This Scheme

The Post Office RD is well-suited for individuals with stable monthly income who want guaranteed returns. It is especially popular among first-time investors, young professionals planning future expenses, and parents saving for children’s education. Retirees and low-risk investors also find the scheme attractive due to its government backing.

Flexibility and Account Management

The scheme offers flexibility through easy account opening, either individually or jointly. Investors can also benefit from loan facilities against the RD account after a certain period. While premature closure is allowed under specific conditions, holding the account until maturity ensures maximum benefit.

Tax Treatment and Safety

Interest earned on the Post Office RD is taxable according to the investor’s income slab, but the scheme’s biggest strength lies in its safety. Being government-backed, it carries virtually no risk, making it one of the most secure savings instruments available in 2025.

Why Post Office RD Remains Popular in 2025

In an environment of market volatility and fluctuating returns, many investors prefer certainty. The Post Office RD offers assured returns, disciplined savings, and peace of mind. Its simplicity and reliability continue to make it a preferred choice for long-term financial planning.

Final Thoughts

Saving ₹10,000 every month in a Post Office RD can help build a sizable corpus of around ₹7.13 lakh in five years. For those who value safety, consistency, and predictable returns, this scheme remains a strong and dependable investment option in 2025.